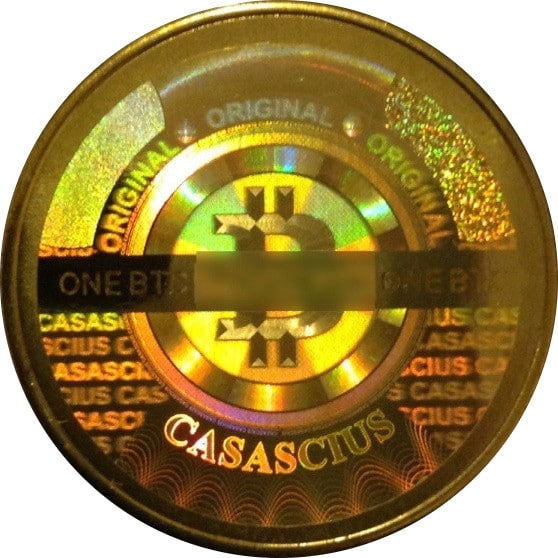

Beware you barrons of BitCoin – you World of Warcraft one-percenters: the long arm of the Internal Revenue Service may soon be reaching into your treasure hoard to extract Uncle Sam’s fair share of your virtual treasure. That’s the conclusion of a new Government Accountability Office (GAO) report on virtual economies, which found that many types of transactions in virtual economies – including bitcoin mining and virtual currency transactions that result in real-world profit – are likely taxable under current U.S. law, but that the IRS does a poor job of tracking such business activity and informing buyers and sellers of their duty to pay taxes on virtual earnings. The report, “Virtual Economies and Currencies: Additional IRS Guidance Could Reduce Tax Compliance Risks” (GAO-13-516) was released this week. It was prepared in response to a request from the U.S. Senate Committee on Finance, which asked GAO to look into virtual […]

Banking

Fraud Analytics: You’re Doing It Wrong!

One of the most vexing problems in computer security today is distinguishing malicious from legitimate behavior on victim networks. Sophisticated cyber criminals and nation-backed hacking groups make a point of moving low and slow on compromised end points and networks, while victim organizations are (rightly) wary of disrupting legitimate business activity for the sake of spotting a breach. In this Security Ledger Podcast, Paul interviews Jason Sloderbeck, Director of Product Management at RSA, EMC’s security division. Jason talks about RSA’s Silvertail fraud analytics technology, and the organizational and technology issues that keep victims from spotting attacks. One of the big mistakes organizations make when they investigate attacks, Sloderbeck said, is focusing too narrowly on a point in time during a web session that is felt to be a good indicator of compromise – like when a user authenticates to a service or “checks out” on an e-commerce web site. “There’s a whole […]

Welcoming A New Sponsor: Gemalto

Just a note to my loyal readers that The Security Ledger is welcoming a new sponsor this week: Gemalto. If you’re not familiar with them, Gemalto NV (GTO) is a ~3B firm that makes a wide range of software for e-identity documents, chip payment cards, network authentication devices and wireless modules, as well as the software to manage confidential data and secure transactions in the telecommunications, financial services, e-government, and information technology security markets. This is an especially exciting win for The Security Ledger because Gemalto, with 10,000 employees and offices in 46 countries is a key supplier to the global Internet of Things. Products like its Protiva platform provide the foundation of trust that undergirds online person-to-machine and machine-to-machine transactions and exchanges of all kinds: on mobile devices, smart cards, medical devices, automobiles and more. We’re really excited to have Gemalto on board as a Security Ledger sponsor. Please join […]

New Banking Trojan Hacks The FAQ To Fool Users

Cyber criminals are notoriously crafty and persistent, especially when it comes to defeating security measures created to thwart them. But a group behind a recent version of the Ramnit banking malware has raised their game to a new level: hacking the customer FAQ (frequently asked questions) document to make their malicious activity look like it was business-as-usual. A report on Tuesday by the security firm Trusteer finds that new variants of Ramnit targeting a UK bank have added features to game a one-time-password (OTP) feature at the bank. Among other tricks, the Ramnit variant uses an HTML injection attack to alter the wording of the bank’s customer FAQ, making it seem as if prompts created by the malware were standard security features at the bank. The report, published on the Trusteer blog, described a complex ruse in which Ramnit lies dormant on infected machines, then springs to action once a […]

Data Breach For Dummies: Simple Hacks, Hackers Are The Norm

In spite of widespread media attention to the problem of “advanced persistent threats” and nation-backed cyber espionage, most cyber attacks that result in the theft of data are opportunistic and rely on unsophisticated or non-technical means, according to Verizon’s 2013 Data Breach Investigations Report (DBIR). Verizon said that its analysis of 47,000 security incidents and 621 confirmed cases of data loss showed that three-quarters were “opportunistic” – not targeted at a specific company or individual – and financially motivated. Around 20 percent of attacks were linked to what Verizon termed “state affiliated actors” conducting cyber espionage. Verizon’s annual Data Breach Investigations Report presents the results of investigations conducted by Verizon’s RISK investigators, the U.S. Department of Homeland Security, US-CERT as well as by law enforcement agencies globally. In its sixth year, it is a highly regarded and oft-cited benchmark of malicious activity and threats to organizations. In a press release […]