In this week’s episode, #118: modern computer games are like mini economies and that makes them a big target for hackers. We talk with four leading researchers from Bug Crowd about how even popular games fall down on security. Also: Srinivas Mukkamala, the CEO of RiskSense about how artificial intelligence and risk based approaches to securing elections systems could pay off.

Gaming

On the Internet of Things, Failure is a Virtue

In-brief: Cisco’s Marc Blackmer argues that fail fast, fail often is as relevant to securing the IoT as it is to developing new IoT products.

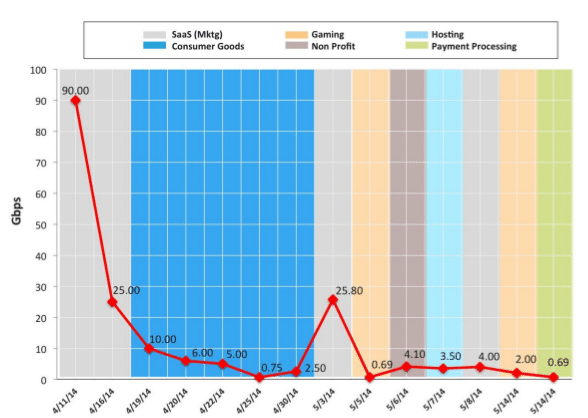

Akamai: New DoS Tool Leads To Resurgence of SNMP Attacks

The security firm Akamai issued an advisory to customers on Thursday warning that a new software tool for managing distributed denial of service (DDoS) attacks was leading to a resurgence in large-scale attacks that use Simple Network Management Protocol (SNMP) traffic to overwhelm web sites. The Threat Advisory (reg wall) was issued by Akamai’s Prolexic Security Engineering and Response Team (or PLXsert). According to the advisory, Akamai began noticing a resurgence in DDoS attacks using SNMP on April 11. The company said that firms in industry verticals including consumer goods, gaming, online hosting and Software-as-a-Service and non-profits had all been targeted. [Read more Security Ledger coverage of DDoS attacks here.] The company has identified new- and updated tools in the cyber underground, including one dubbed SNMP Reflector – that are enabling the attacks. Simple Network Management Protocol (SNMP) is a protocol that is used for managing devices on a network including […]

Beware BitCoin Users: The Tax Man Cometh!

Beware you barrons of BitCoin – you World of Warcraft one-percenters: the long arm of the Internal Revenue Service may soon be reaching into your treasure hoard to extract Uncle Sam’s fair share of your virtual treasure. That’s the conclusion of a new Government Accountability Office (GAO) report on virtual economies, which found that many types of transactions in virtual economies – including bitcoin mining and virtual currency transactions that result in real-world profit – are likely taxable under current U.S. law, but that the IRS does a poor job of tracking such business activity and informing buyers and sellers of their duty to pay taxes on virtual earnings. The report, “Virtual Economies and Currencies: Additional IRS Guidance Could Reduce Tax Compliance Risks” (GAO-13-516) was released this week. It was prepared in response to a request from the U.S. Senate Committee on Finance, which asked GAO to look into virtual […]