In-brief: A study by Cisco Systems found that innovation will drive a major shakeup in the retail banking sector, with concerns about cyber security a major roadblock to innovation.

Technology innovation including “Big Data” analytics and the Internet of Things is posed to transform the retail banking sector in the next decade, according to a new economic analysis by Cisco Systems. And companies that can’t manage the transition to new technology-driven models risk going the way of the dinosaur.

Digital innovation in retail banking will drive $405 billion in new value creation and value reallocation between 2015 and 2018 in the retail banking sector, with four in ten incumbent firms at risk of being “displaced” in the process, Cisco found. Cyber security is a major stumbling block, with fears about breaches eroding consumer trust.

Retail banks will face rising pressure from new, technology-fueled “fintech” competitors, as well as incumbents from previously non-competitive sectors, like technology, Cisco warned. With firms like Apple, Google and Microsoft eyeing lucrative markets like payments and banking “every retail bank must think like a tech company,” Cisco said.

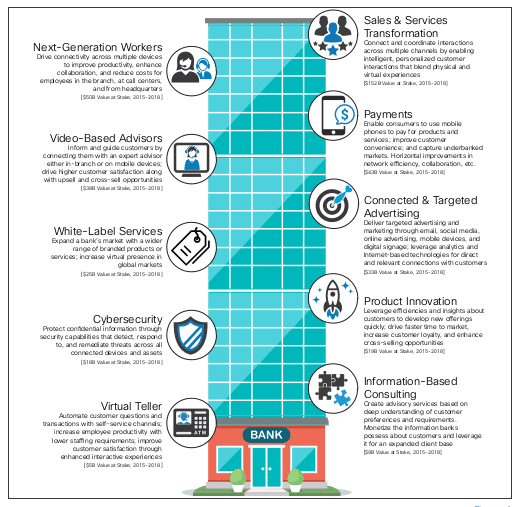

Technology innovation has the potential to transform functions like sales and services, customer support, payments, marketing as well as cybersecurity. But financial services firms have yet to realize those transformations and, thus, miss out on more than 70% of the potential advantage of such new services in 2015. Cisco estimates that incumbents in retail banking missed out on $144 billion in value creation between 2011 and 2015.

Security figures prominently in the successful transformation of traditional banking firms to technology driven financial firms, Jason Bettinger, Cisco’s Director of Financial Services told Security Ledger. “For companies making the digital transformation, a lot was continent on addressing security and making customers feel secure.”

[Read more Security Ledger coverage of financial services.]

Financial services firms and banks are disproportionately targeted by cyber criminals and the cost of data breaches are higher for banking and financial services firms than for companies in other industries, Bettinger notes. “Banks want to try to enable new capabilities, but they need to balance it – and do all they can from cyber standard to keep their business safe,” he said.

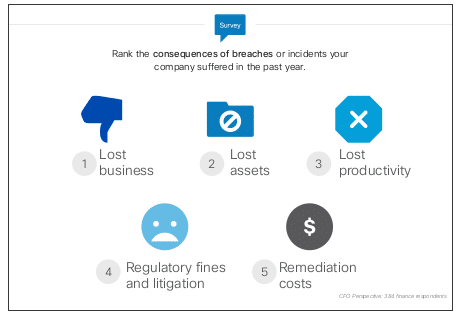

Still, Cisco found that concerns about security may stifle development of new services and capabilities that – over time – could transform businesses and industries. A Cisco survey of 1014 senior finance and line of business executives found that 71% agreed that cybersecurity risks and threats hindered innovation in their organization.

Thirty nine percent of those surveyed said their company had recently stopped a mission critical initiative due to cyber security concerns. Others were reluctant to pursue initiatives because of the perceived digital risk, Bettinger said.

The cost to those businesses of delayed innovation can be huge and could even make the difference between charging ahead in a new “fintech” market, or being displaced by it: as billions of dollars of value migrate from less innovative firms to their more innovative competitors.

Cisco singles out “secure digitizers” as the companies most likely to succeed. At such firms, there is more confidence in the security of key areas such as Big Data, cloud and Internet of Things. “This confidence makes them more willing to pursue digital offerings, thereby accelerating innovation and time to market,” Cisco said.

The findings echo other recent studies, including one by the U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA), which found that public faith in the Internet has dimmed in the wake of data breaches, cybersecurity incidents, and reports critical of the privacy practices of online services.

Nineteen percent of Internet-using households surveyed by NTIA reported having been affected by an online security breach, identity theft, or similar malicious activity during the prior 12 months. That correlates with some 19 million households, NTIA said. No surprise: direct experience of adverse events online is deterring people from participating in some kinds of online activities. Forty five percent of those surveyed said they refrained from conducting financial transactions online, making purchases or expressing personal opinions on controversial issues.